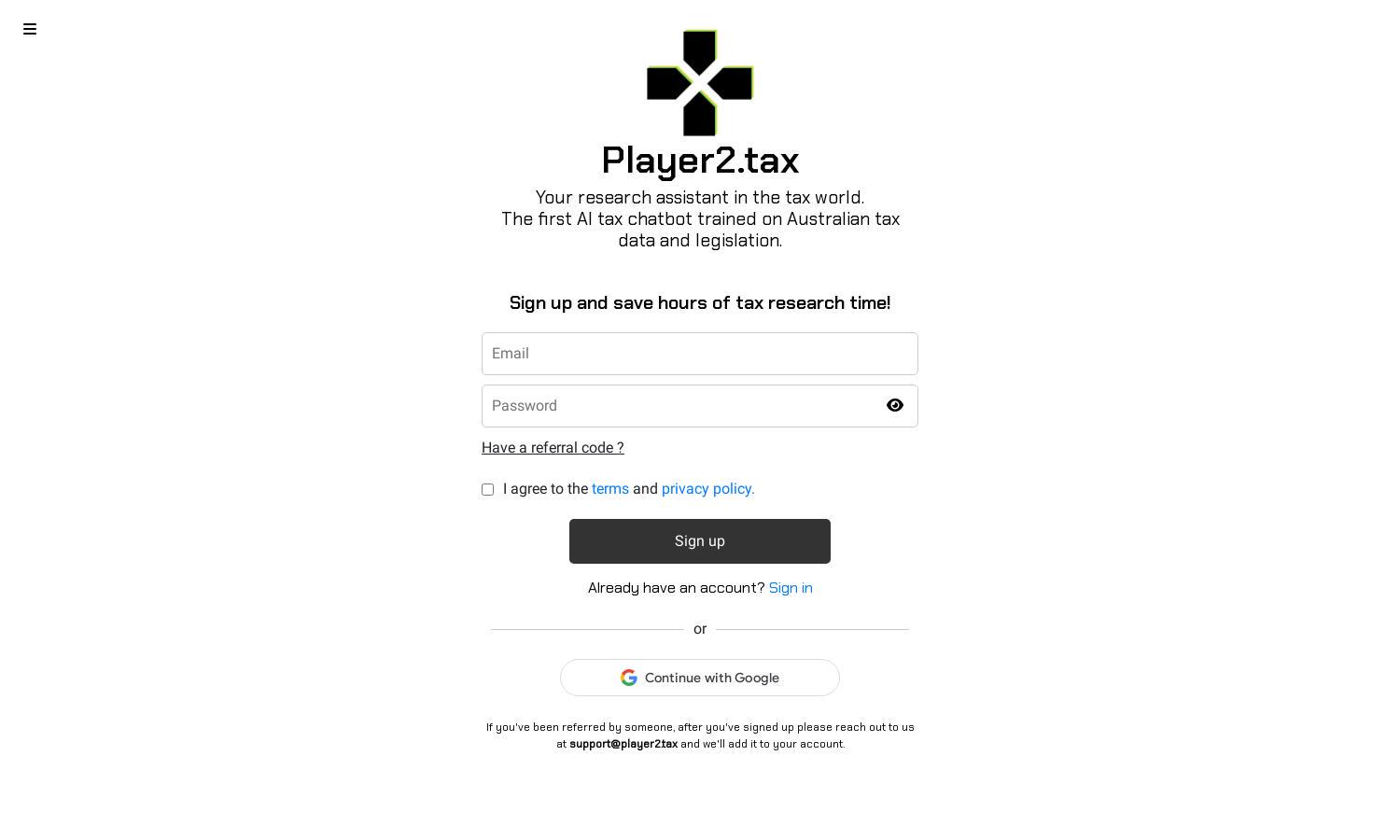

Player2.tax

About Player2.tax

Player2.tax is a revolutionary AI tax chatbot that serves as a reliable research assistant for Australians. It simplifies tax inquiries by providing accurate information based on robust legislative data. Users benefit from reduced research time, making it essential for both individuals and businesses navigating the complex tax landscape.

Player2.tax offers various pricing plans to suit different user needs. Each subscription tier provides distinct benefits, such as advanced features and priority support. Users can enjoy significant savings and enhanced functionality by opting for higher tiers, ensuring an efficient tax research experience.

The user interface of Player2.tax is designed for intuitive navigation, ensuring a seamless browsing experience. Its clean layout and user-friendly features allow users to swiftly access information, making the tax inquiry process straightforward and efficient, ultimately enhancing user satisfaction.

How Player2.tax works

Users begin their journey with Player2.tax by signing up, after which they can log in to access a range of tax-related topics. The chatbot can provide personalized insights based on Australian tax legislation and data, fostering a user-friendly atmosphere that simplifies complex inquiries efficiently.

Key Features for Player2.tax

AI Tax Chatbot

The AI Tax Chatbot feature of Player2.tax stands out as a unique tool for users. It leverages vast Australian taxation data to deliver tailored advice, ensuring users receive accurate information quickly and efficiently, helping them navigate tax complexities with ease.

Tax Legislation Insights

Player2.tax offers in-depth insights into Australian tax legislation, allowing users to easily access relevant laws and regulations. This feature empowers users to stay informed and compliant, significantly aiding them in making well-informed financial decisions.

Personalized Tax Guidance

The Personalized Tax Guidance feature of Player2.tax provides users with tailored advice based on their unique circumstances. This ensures that each user receives relevant recommendations, making tax planning and compliance more manageable and efficient for individuals and businesses alike.

You may also like: