CPA Pilot

About CPA Pilot

CPA Pilot helps tax professionals optimize their workflows with AI-powered tax assistance. By offering instant access to authoritative sources and expert guidance, this platform streamlines tax research and client communications, enabling accountants to make better strategic decisions, communicate effectively, and ultimately enhance client satisfaction.

CPA Pilot features three subscription tiers: Light Users (20 messages/month), Average Users (60 messages/month), and Power Users (150 messages/month). Plans offer a 7-day free trial and the option for a pay-as-you-go approach, ensuring that users receive extensive support and insights at competitive prices.

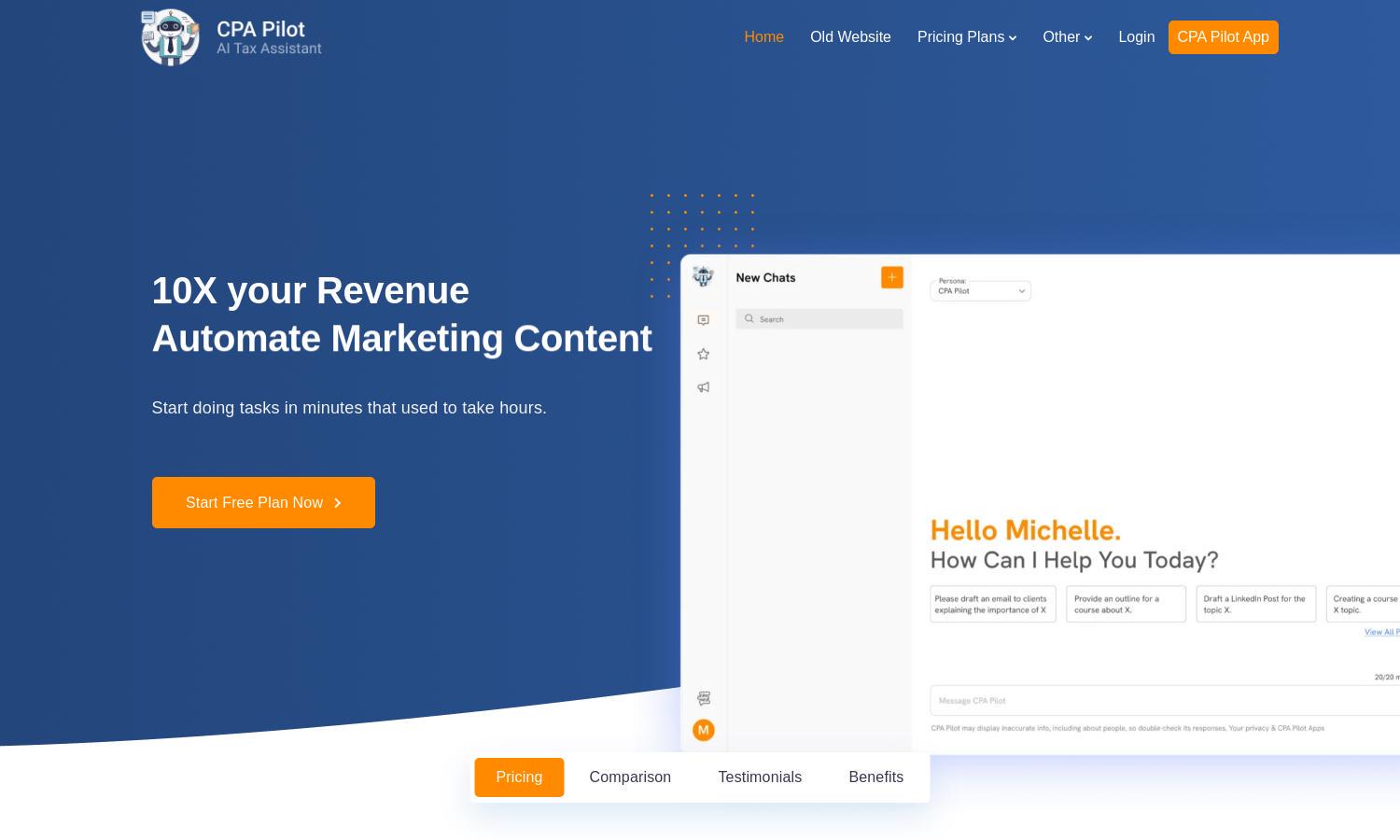

The user-friendly interface of CPA Pilot simplifies tax assistance. With easy navigation and quick access to key features like tax research and client communication tools, CPA Pilot ensures a seamless experience for tax professionals seeking to enhance their productivity and reduce time spent on tedious tasks.

How CPA Pilot works

Users begin their interaction with CPA Pilot by signing up for one of the subscription plans, including a free trial. Once onboarded, they can access a comprehensive suite of features, from real-time tax research to client communication. Users simply input their questions or tasks, and CPA Pilot leverages its AI to deliver accurate, authoritative answers, thereby streamlining their workflow and making tax management more efficient.

Key Features for CPA Pilot

AI-Driven Tax Research

CPA Pilot's AI-driven tax research feature allows tax professionals to obtain precise answers to complex inquiries nearly instantly. By accessing a range of authoritative sources, CPA Pilot transforms tedious research tasks into efficient processes, saving users valuable time and enhancing accuracy in their work.

Instant Technical Support

The Instant Technical Support feature of CPA Pilot provides users immediate assistance with their preferred tax software. This unique offering eliminates the frustration of traditional support channels, enabling tax professionals to resolve issues quickly and stay focused on providing excellent client service.

Tailored Tax Strategies

CPA Pilot excels at generating tailored tax strategies for clients, allowing accountants to develop bespoke plans that address unique financial situations. This distinctive feature empowers tax professionals to offer personalized services while optimizing compliance and maximizing client benefits, ultimately enhancing their practice's value.