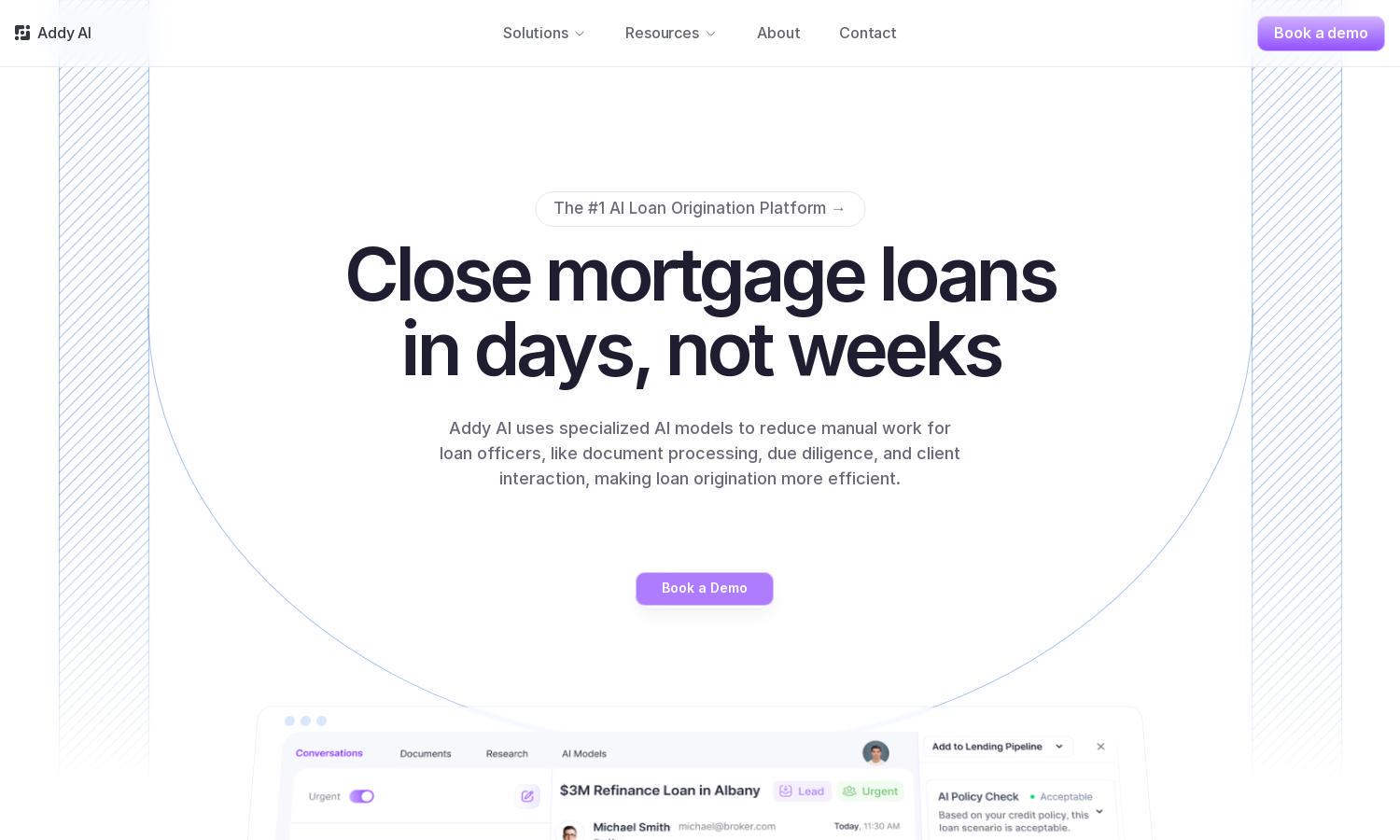

Addy AI

About Addy AI

Addy AI empowers mortgage lenders to close loans efficiently by automating the loan origination process. With specialized AI models, users can streamline tasks like document processing and client follow-up, saving time and enhancing productivity. Addy AI is perfect for lenders who prioritize efficiency and client satisfaction.

Addy AI offers flexible pricing plans tailored to lender needs. Users can choose from basic to premium tiers, each providing increasing automation capabilities and support. By upgrading, users gain access to advanced features that drive efficiency and improve loan processing times, ultimately benefiting their business.

The user interface of Addy AI is designed for a seamless experience, featuring an intuitive layout that enhances navigation. Users can easily access essential tools, integrate various systems, and manage their workflows efficiently. Unique features enable a smooth user journey, making Addy AI accessible and effective for mortgage lenders.

How Addy AI works

Users begin their journey with Addy AI by signing up and completing a straightforward onboarding process. During setup, they can integrate their existing systems, such as CRM and loan origination tools. Once onboarded, users navigate through an intuitive dashboard to access document processing, data extraction, and automated follow-ups, efficiently managing workflows and enhancing productivity.

Key Features for Addy AI

Custom AI Model Training

Addy AI allows users to train custom AI models, tailoring the automation process to specific mortgage lending needs. This unique feature enhances efficiency in loan origination by automating tasks and providing instant insights, helping lenders save time and focus on client relationships.

Document Processing Automation

The document processing automation feature of Addy AI simplifies the extraction and handling of crucial loan data. By leveraging advanced AI technology, users can quickly process documents like bank statements and W2s, significantly reducing turnaround times and increasing productivity in the mortgage lending process.

Client Follow-Up Automation

Addy AI's client follow-up automation enables lenders to engage borrowers and brokers seamlessly. By training specialized AI models, users can automate follow-ups 24/7, ensuring timely communications and enhancing client satisfaction. This feature is crucial for maintaining a competitive edge in the lending market.

You may also like: