About Invoice Guru

Invoice Guru is a revolutionary mobile-first invoicing app designed from the ground up for tradespeople, freelancers, and small service businesses. If you're a plumber, electrician, painter, builder, or cleaner, you know that traditional accounting software is built for desktops and office work, not for the on-site, fast-paced reality of your job. Invoice Guru changes that. It puts the power to create, send, and track professional invoices directly in your pocket, allowing you to manage your business finances from your phone in seconds, not hours. The core value is simple: dramatically reduce admin time so you can focus on the work you love and get paid faster.

Built by a tradesperson who understands the daily challenges, the app focuses on speed, simplicity, and smart automation. Beyond just creating invoices, it automates the tedious parts of running a business. It can scan receipts with AI, match bank payments automatically, send smart payment reminders, and generate reports for your accountant. Crucially, Invoice Guru is built with compliance in mind, ready for regulations like the UK's Making Tax Digital (MTD) and Poland's KSeF, ensuring you won't need to switch tools when rules change. It’s more than an invoicing tool; it's a complete financial assistant for the modern tradesperson.

Features of Invoice Guru

Instant Mobile-First Invoice Creation

Create and send a fully branded, professional invoice in less than 60 seconds directly from your phone. Simply enter your client's details and add service items. The app automatically adds your logo, company info, VAT, and payment terms, generating HMRC-compliant templates so you never have to fiddle with Word or Excel again. It's designed for use on a job site, making invoicing quick and effortless.

AI-Powered OCR Receipt Scanner

Stop manually typing in expense details. Simply snap a photo of any paper receipt with your phone's camera. Invoice Guru's AI technology instantly reads and extracts all key details like the supplier name, date, total amount, and VAT. It then automatically saves this as a categorized expense entry, making bookkeeping and cost tracking seamless and accurate.

Smart Bank Integration & Payment Tracking

Connect your business bank account securely to automate your cash flow tracking. Invoice Guru automatically matches incoming bank payments with their corresponding unpaid invoices in your account. You get a real-time, clear view of who has paid, what's still overdue, and what might need a friendly reminder, all without manual data entry.

Automated Compliance & Multi-Language Support

Invoice Guru is built for the future of business compliance. It prepares you for upcoming regulations like UK MTD with approved templates and workflows. Furthermore, it supports over 12 languages and multiple currencies (like GBP, EUR, PLN), allowing you to easily work with clients across the UK and Europe using local formats and terms.

Use Cases of Invoice Guru

For the On-Site Tradesperson Needing Speed

A plumber finishes a job and wants to invoice the client before leaving the property. Instead of waiting to get back to the office, they open Invoice Guru on their phone, select the client, add the parts and labour, and hit send. The professional invoice lands in the client's email instantly, speeding up payment and projecting a professional image right on the spot.

For Managing Business Expenses and Receipts

A builder collects receipts for materials from various suppliers throughout the week. Rather than letting them pile up in a glove box, they use the OCR receipt scanner in Invoice Guru to photograph each one immediately. The AI logs all expenses automatically, creating a perfect digital record for VAT returns and accountant reports without any manual hassle.

For Tracking Cash Flow and Chasing Late Payments

A freelance electrician has multiple outstanding invoices. By using the bank integration feature, they can see at a glance which payments have cleared automatically. For overdue invoices, the app's smart reminder system can automatically send polite follow-up emails based on a schedule they set, saving them the awkwardness of manual chasing.

For Small Businesses Expanding Internationally

A cleaning company starts working with clients in another European country. Using Invoice Guru, they can easily switch the invoice currency to Euros, adjust the language, and ensure the document format meets local standards. This professional approach helps them expand their services without administrative headaches.

Frequently Asked Questions

Is Invoice Guru compliant with UK Making Tax Digital (MTD) rules?

Yes, Invoice Guru is designed with MTD compliance as a core principle. It uses HMRC-compliant invoice templates and is being developed as officially approved MTD software. This means you can confidently use it to create, store, and report your VAT information digitally as required by HMRC, future-proofing your business.

How does the 10-day free trial work?

The free trial gives you full, unrestricted access to all of Invoice Guru's premium features for 10 days. You can create and send real invoices, test the receipt scanner, and explore the bank integration. No credit card is required to sign up for the trial, so you can explore the app risk-free and see how it transforms your workflow.

Can I use Invoice Guru on a desktop computer or is it only mobile?

While Invoice Guru is proudly mobile-first and optimized for use on your smartphone or tablet, you can also access your account and manage your invoices through a web browser on your desktop or laptop computer. This gives you flexibility to work from any device.

Is my financial and bank data secure with Invoice Guru?

Security is a top priority. Bank connections use secure, read-only access via trusted, bank-grade financial data providers (like open banking APIs). This means the app can see transaction details to match payments but cannot move any money or make payments from your account. Your data is encrypted and protected.

Pricing of Invoice Guru

Currently, Invoice Guru is offering an exclusive early access program. You can join as an early tester and receive 1 month of service for free in exchange for your valuable feedback. This is a limited-time offer with no credit card required to sign up. After the early access period, standard subscription plans will be introduced. You can visit their website or join the early access list to get the most up-to-date information on future pricing tiers and features.

You may also like:

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

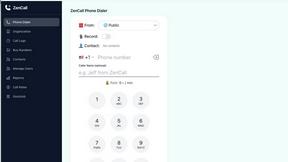

ZenCall

Browser-based international calling with transparent pay-as-you-go pricing. No apps, no subscriptions—just affordable global calls.

ExpenseManager

All-in-one app to track expenses, split bills, scan receipts, and forecast cash flow — for individuals, couples, and groups.