Skwad

About Skwad

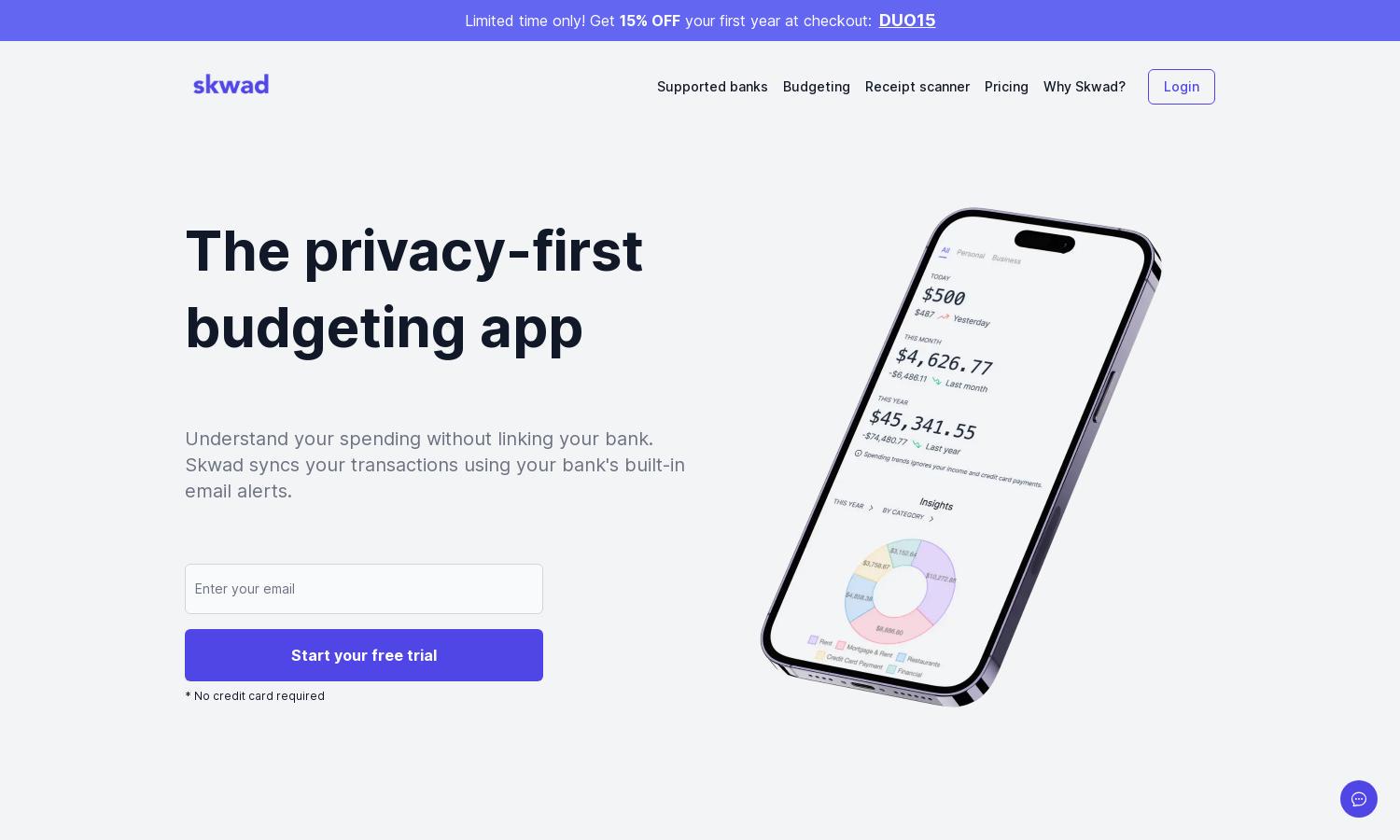

Skwad is a privacy-focused budgeting app created for users who want financial clarity without compromising their security. By leveraging your bank’s email alerts, Skwad simplifies expense tracking and categorization, allowing you to efficiently manage your finances while ensuring your data remains confidential.

Skwad offers different subscription tiers, allowing users to choose the plan that best suits their needs. A 15% discount is available for the first year with code DUO15. Each plan provides access to essential budgeting features, enhancing user experience and financial management.

Skwad's user interface is intuitive and designed for seamless navigation. Its layout prioritizes user experience, showcasing essential features prominently while providing quick access to budgeting tools. The minimalist design ensures that users can efficiently manage their financial activities without unnecessary distractions.

How Skwad works

To use Skwad, users sign up and receive a unique Skwad scan email address. They can set up automated spending alerts from their bank, forward alerts to Skwad, and the app automatically categorizes these transactions. With no need for bank login, users enjoy instant transaction syncing and improved financial oversight.

Key Features for Skwad

Automated Transaction Categorization

Skwad’s automated transaction categorization feature revolutionizes budgeting by instantly organizing your financial activities. Users can forward email alerts from their bank to Skwad, which processes these alerts and classifies transactions for better financial tracking and clarity, enhancing overall budgeting efficacy.

Privacy-Focused Design

Skwad stands out with its privacy-first design, ensuring users do not have to share sensitive bank login information. This unique feature protects users' financial data, allowing them to budget confidently while retaining complete control over their financial information.

Multiplayer Budgeting Mode

Skwad’s multiplayer budgeting mode allows users to collaborate on financial goals with friends or family. This feature encourages shared accountability, enabling users to manage budgets collectively and eliminate debt more effectively, fostering a supportive financial environment.

You may also like: