Sixfold

About Sixfold

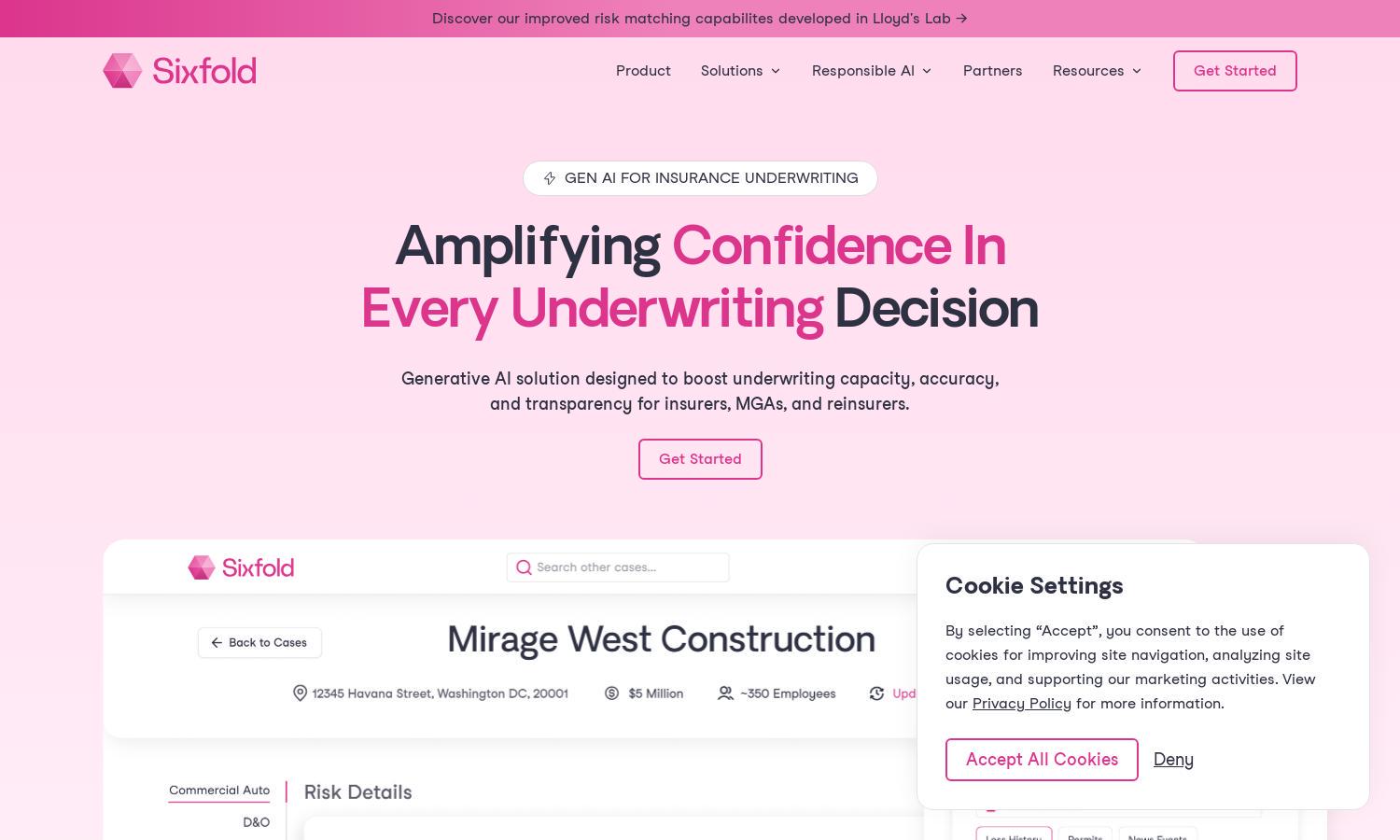

Sixfold offers advanced generative AI tools specifically designed for insurance underwriters, automating tedious tasks and providing tailored risk insights. By ingesting underwriting guidelines and extracting key data, Sixfold enables efficient decision-making, enhancing workflow and ultimately solving the challenges faced by insurance professionals.

Sixfold provides a range of pricing plans to accommodate different user needs, each offering valuable features tailored for insurance underwriters. Higher tiers unlock additional functionalities like enhanced risk insights and personalized support, perfect for organizations aiming to optimize their underwriting processes while maximizing ROI.

The user interface of Sixfold is designed for seamless navigation, emphasizing intuitive layout and user-friendly features. This design facilitates easy access to the platform’s innovative generative AI tools, enhancing the overall user experience and ensuring that underwriters can efficiently utilize the technology at their fingertips.

How Sixfold works

Users begin their journey with Sixfold by onboarding their underwriting guidelines into the system. Once integrated, the platform automatically extracts relevant risk data and analyzes it against these guidelines. Following this, users receive tailored recommendations and insights, all delivered in an easy-to-understand format, allowing underwriters to make informed decisions quickly and efficiently.

Key Features for Sixfold

Automated Risk Insights

Automated risk insights are a core feature of Sixfold, transforming the underwriting process. By leveraging generative AI, Sixfold provides underwriters with tailored risk assessments, allowing for faster, data-driven decision-making. This feature enhances efficiency and accuracy in the underwriting workflow, ultimately benefiting insurance companies.

Transparent Decision-Making

Sixfold emphasizes transparency in underwriting decisions, showcasing its unique competitive advantage. By providing full sourcing and traceability for all decisions, users can trust the AI's recommendations without fearing the black box effect. This transparency builds confidence and facilitates regulatory compliance, enhancing overall performance for underwriters.

Seamless Integration

Sixfold’s seamless integration with existing technologies is an additional key feature that sets it apart. Underwriters can easily plug Sixfold into their current systems without overhauling infrastructure, thereby maximizing efficiency and leveraging generative AI capabilities to enhance risk assessment processes while preserving existing workflows.

You may also like: