Circler

About Circler

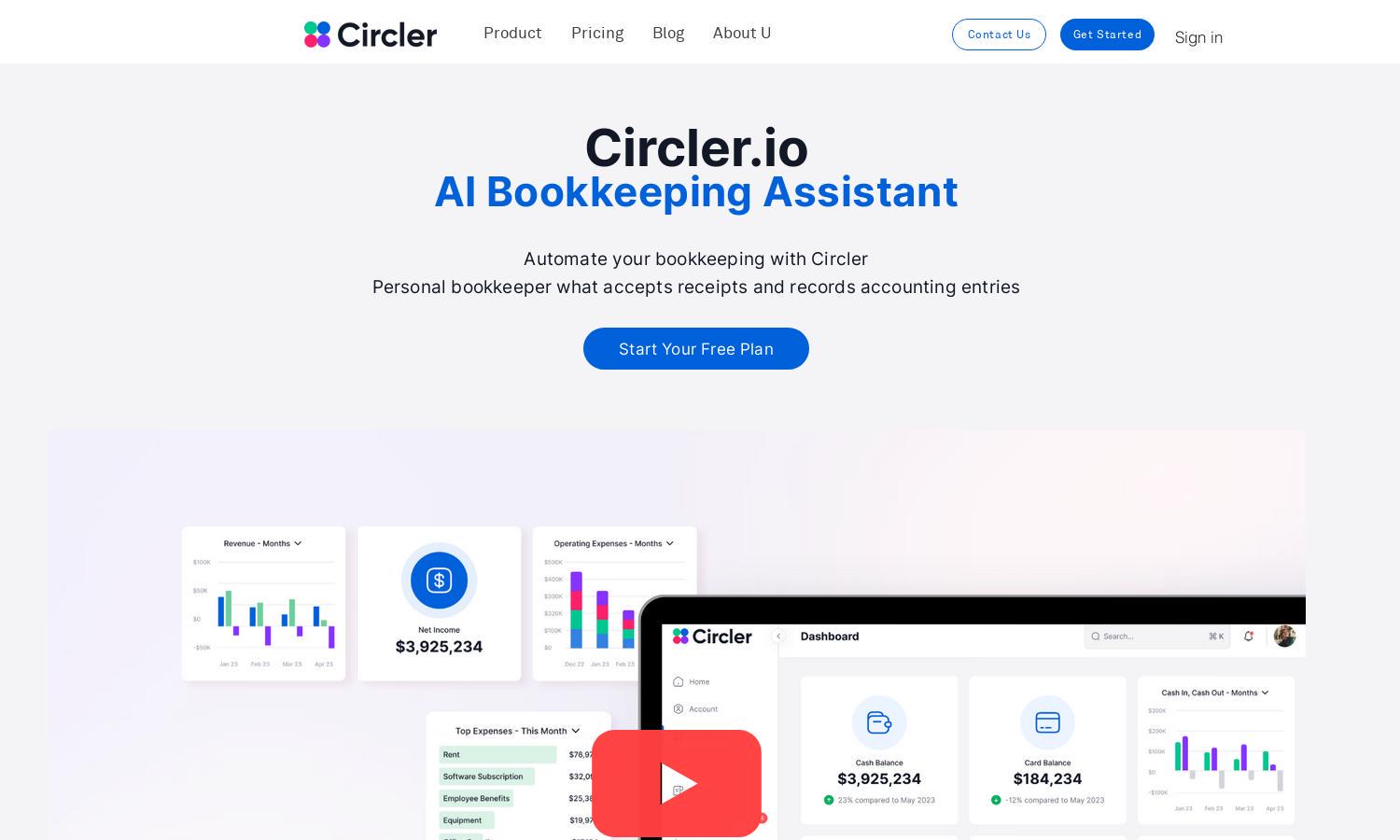

Circler.io is an innovative AI bookkeeping platform tailored for small businesses and freelancers. It simplifies financial processes, offering features like automated receipt scanning, real-time financial insights, and secure data storage. With Circler.io, users can focus on business growth while effortlessly managing their finances.

Circler.io offers a free plan with essential features to get started and a Pro plan for advanced functionality. The Pro subscription includes receipt scanning, invoicing, and bank reconciliation, available with a 14-day free trial. Upgrade anytime to streamline your bookkeeping and maximize efficiency.

The user interface of Circler.io is designed for effortless navigation and clarity. Its intuitive layout allows users to access key features quickly and manage finances efficiently. With a personalized dashboard, Circler.io ensures a user-friendly experience that empowers informed decision-making without complexity.

How Circler works

To start using Circler.io, users sign up for a free plan and connect their bank accounts. They can then snap photos of receipts, allowing the AI to automatically extract and categorize expenses. With real-time financial insights displayed on a clear dashboard, users can efficiently reconcile accounts and monitor cash flow effortlessly.

Key Features for Circler

Effortless Receipt Scanning

Circler.io offers effortless receipt scanning, allowing users to snap photos for easy data extraction. This innovative feature saves time and reduces manual data entry, making bookkeeping simple and efficient for small businesses and freelancers looking to optimize their financial processes.

Smart Expense Categorization

With smart expense categorization, Circler.io intelligently sorts expenses based on a pre-built Chart of Accounts. This unique feature reduces the time users spend organizing finances, allowing them to focus more on business growth and less on bookkeeping complexities.

Instant Bank Sync

Circler.io features instant bank sync, connecting users' bank accounts for live transaction updates. This functionality simplifies reconciliation processes, ensuring that users can track their finances in real-time, making it easier for small businesses to maintain accurate and up-to-date financial records.