Chart

About Chart

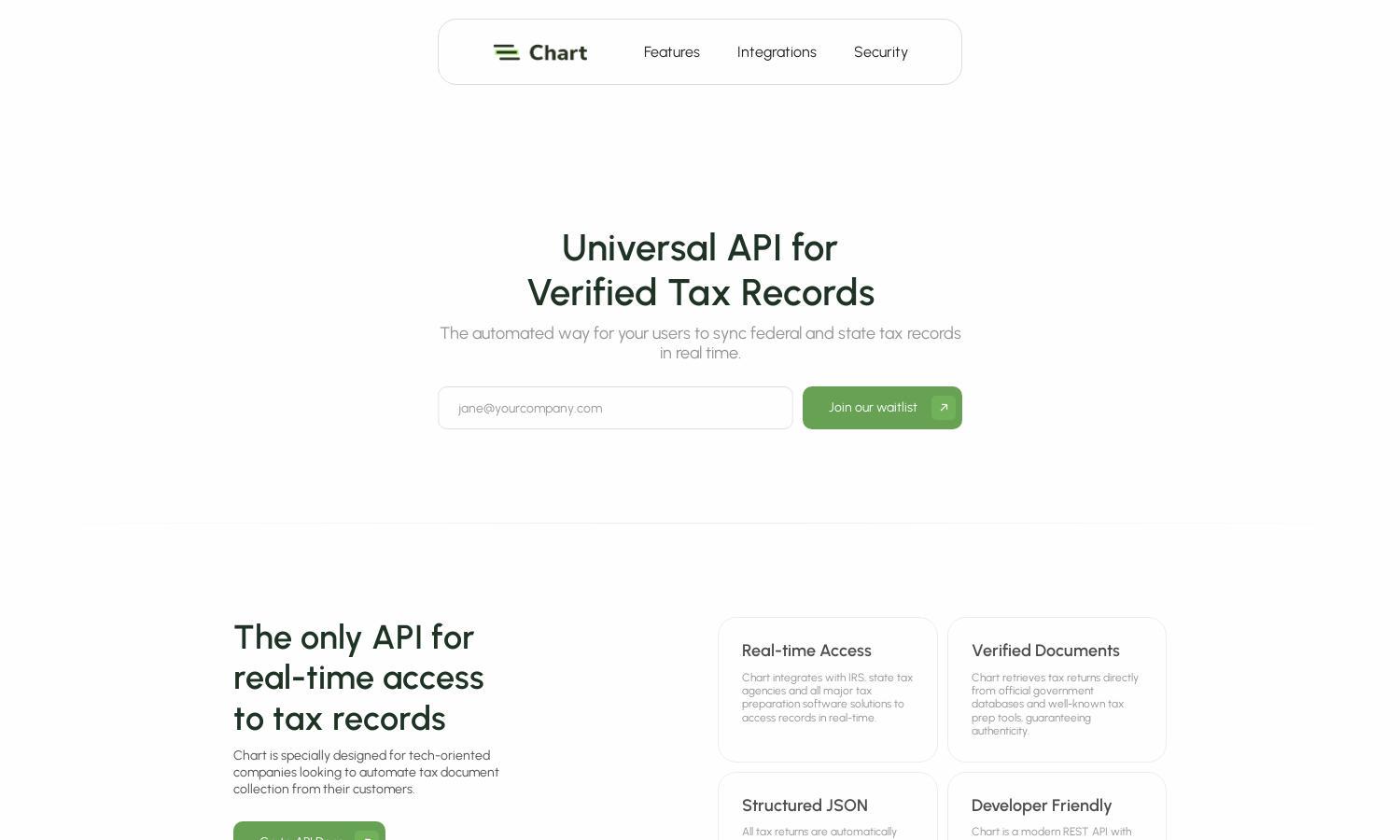

Chart is a modern API designed for tech companies seeking efficient and verified tax document collection. Targeting developers and financial services, Chart simplifies the process by integrating real-time access to federal and state tax records. Its standout feature is user-friendly document submission, enhancing efficiency and accuracy.

Chart offers flexible pricing plans tailored to various business needs. Users can choose from basic to enterprise tiers, each providing essential features and access to advanced capabilities. Special discounts may be available for long-term commitments, allowing users to leverage Chart’s powerful API while optimizing budget considerations.

Chart's user interface is designed for seamless interaction, featuring a clean layout that prioritizes user experience. Navigation through the platform is intuitive, allowing users to access documentation and tools effortlessly. Unique features, such as structured JSON outputs and consent flows, further enhance the usability of Chart.

How Chart works

Users begin their journey with Chart by signing up for an account and selecting a subscription plan that fits their needs. After authentication, they can easily integrate with IRS and state tax systems or opt to upload documents directly. Chart’s automated document processing ensures swift verification, making tax record access efficient and secure.

Key Features for Chart

Real-time Tax Record Access

Chart provides real-time access to tax records by integrating with various state agencies and IRS systems. This key feature guarantees users can efficiently collect verified tax documents, eliminating the hassles of manual retrieval and ensuring compliance with current regulations, maximizing accuracy and speed.

Verified Documents Retrieval

Chart ensures authenticity by retrieving tax returns directly from official government databases and trusted tax preparation tools. This feature enhances user confidence, as all records are guaranteed verified and reliable, streamlining the process of document collection and validation for financial transactions.

Structured JSON Outputs

Chart transforms tax records into structured JSON objects, making data processing simple and efficient. This feature allows developers to seamlessly integrate tax data into their applications, fostering better data handling and analysis while ensuring users receive accurate and organized information effortlessly.