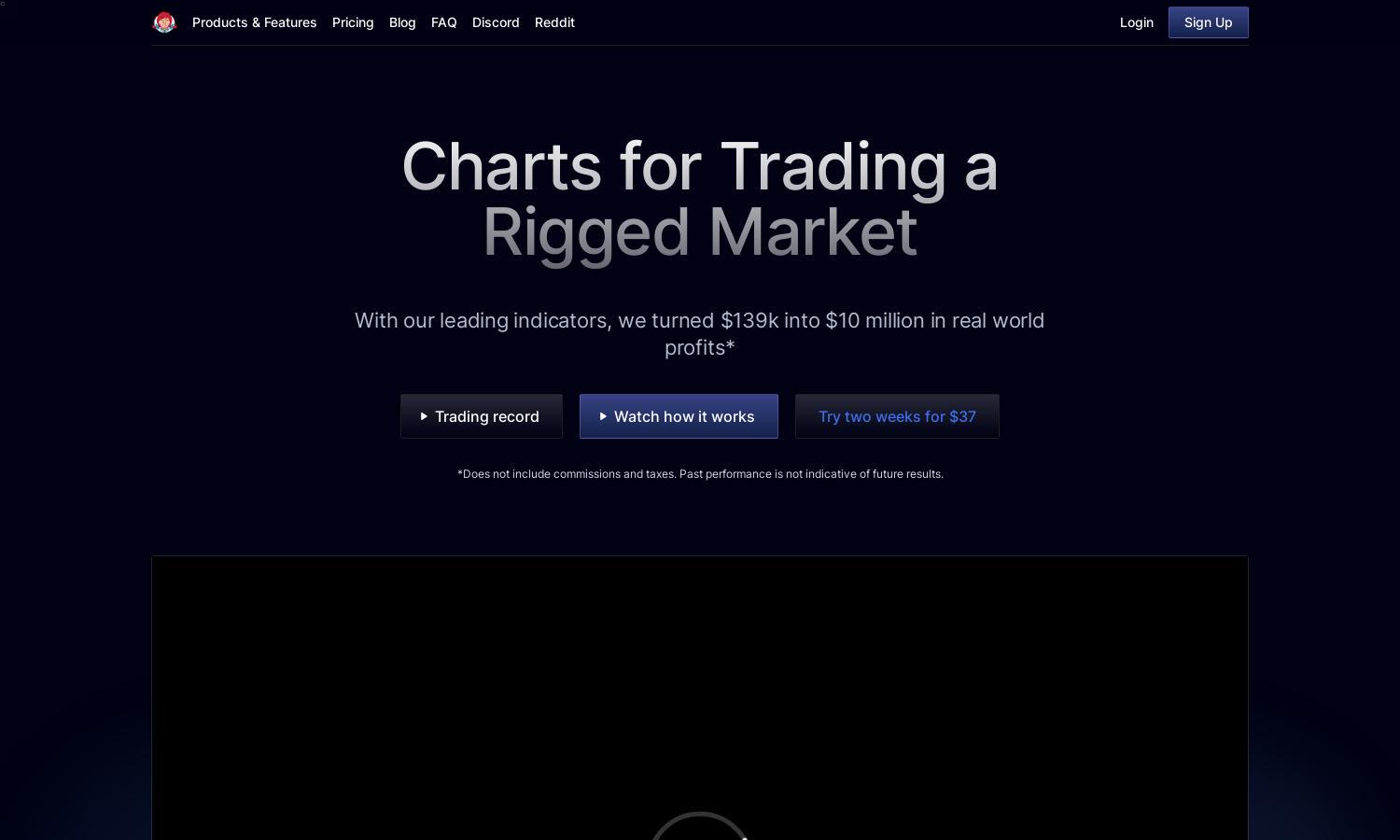

BigShort

About BigShort

BigShort is a cutting-edge platform designed for day traders and swing traders seeking real-time insights. With its innovative predictive trading indicators and unique SmartFlow feature, users can visualize smart money activity and make informed decisions to maximize profits, addressing market inefficiencies.

BigShort offers flexible pricing with a two-week trial for $37, allowing users to explore its features without commitment. Subscription plans provide access to real-time insights, back-tested algorithms, and premium tools. Users upgrade for enhanced trading strategies, maximizing potential returns with data-driven insights.

The user interface of BigShort is designed for seamless navigation, with real-time charts and easy access to SmartFlow data. Its layout prioritizes user experience, enabling traders to efficiently track option flow and market movements while utilizing user-friendly features that enhance decision-making.

How BigShort works

Users begin their journey with BigShort by signing up for the platform, accessing a variety of real-time stock charts and trading indicators. They can leverage unique features like SmartFlow to analyze market trends, view option flow, and identify smart money activity for informed trading strategies.

Key Features for BigShort

SmartFlow Indicator

SmartFlow is a revolutionary feature of BigShort that enables traders to visualize smart money activity in real-time. This proprietary indicator helps users make informed trading decisions by differentiating between smart money and retail volume, ultimately enhancing profit potential and market understanding.

OptionFlow Analytics

BigShort’s OptionFlow Analytics feature provides detailed insights into option blocks, sweeps, and splits, allowing traders to interpret market movements effectively. By overlaying this data on real-time charts, users gain a comprehensive view of market dynamics, empowering better trading decisions.

Dark Pool Visualization

The Dark Pool Visualization feature of BigShort enhances users' trading strategies by providing insights into unseen market transactions. It helps traders identify support and resistance levels through dark pool activity, offering a more comprehensive understanding of market trends and potential price movements.

You may also like: